Meet OSSNA at the convergence of

Digital and Core

Ossna helps Financial Institutions launch Digital Solutions that enable them to offer world class customer experience to their clients.

OSSNA is a fintech engaged in the design and development of technology enabled business solutions for Credit Unions & other Financial institutions with specific focus on Mobile and Core Integration

-

► In the past 10 years we have grown from 1 (one) Financial Institution customer to 30 (Thirty).

► Of the 30 Financial Institutions, 5 are among the top 100 Credit Unions in US.

► Among the 30 Financial Institutions, several are repeat customers and have retained our services for ongoing projects.

► We have collective experience of over 45 years working with FISERV and JACK HENRY's Symitar Core Banking solutions focus on Mobile and Core Integration.

What We Do

We combine our deep understanding and collective Core integration experience of 45 plus years with unparallel skills and qualifications of the newest Mobile technology to assist Financial Institutions and CUSOs to offer world class customer experience to their customers.

Mobile Solutions

Core Integration Solution

Payment

-

Clear Check helps Credit Unions & Financial Institutions to make cash available to members based on Relationship Criteria

-

Semi-automated branch/back-office solution with minimal human intervention for skipping loan payments

-

Semi-automated solution for Dormant Account & Escheatment process with little human intervention.

-

Semi-automated solution for developing NCUA 5300 Call Reports

-

Check 21, Teller and Mobile integration with backend Core Processor

-

Core Process Analysis & Programing

-

Custom Reports & Data Analytics

Skip A Pay

Compliance

RDC

Other Services

Your download link below

Your download link below

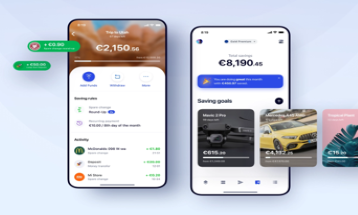

Mobile Solution

Skip A Pay

-

End to end self-service solution for skipping loan payments

-

Direct Deposit and Allocation

-

Goal Based Savings

-

Round Up Savings and Investment

-

Focused Engagement with Members

-

Targeted Marketing and Cross Selling

-

Digital Lending

Onboarding

PFM (Personal Finance Management)

Member Relationship Management

Our Approach

-

OSSNA has adopted the well proven and time honored 4D Methodology engagement model that enables rapid development of exact capabilities needed for the business.

This methodology is based on Agile and iterative execution principles.

OSSNA will team up with customer's Business and IT personnel and provide value and complete transparency throughout the lifecycle of the engagement.

Discover Insight * Understand the pain points Design Ideate * Document Detailed Requirements Develop Create * Code Integration and pre UAT Testing Deploy Implement * Final Phase of QA, UAT and Launch

What do our clients say

"I have been using the professional services of OSSNA for over ten years- earlier when I was at Wright Patt Credit Union and now at Visions FCU. They are a highly professional and dedicated team working to help their clients achieve success. When we have a need to outsource any development work, OSSNA is considered due to their responsiveness and pricing.Our last interaction was the creation of our e-receipt product that has been well received by our membership."

"We engaged with OSSNA to help us streamline some processes for us. We found them to be creative and responsive. They worked closely with our team to design something that would work for us. We appreciated their approach and believe they provided a very cost effective solution to other Epysis programmers."

"We decided to engage OSSNA after seeing potential in their clear check solution. They were open to modifying the solution to fit our needs, and the end result was something that checked off all the major items for us to help create a consistent check hold/hold waiver experience across our channels."

Please let us know how we can help

- 1520 Artaius Pkwy, # 6626, Libertyville, IL 60048, USA

- +1-847-736-1151

- +1-847-984-3117

- sales@ossna.com

About Ossna

OSSNA is a fintech engaged in the design and development of technology-enabled business solutions for Credit Unions & other Financial Institutions with specific focus on Mobile and Core Integration

Links

Copyright Ⓒ OSSNA (IL) LLC 2021-22